Access Bank Embroiled in ₦500m Scandal: Family Alleges Unlawful Withholding of Deceased Customer’s Funds

Access Bank faces allegations of withholding funds from a deceased customer’s account. Family demands justice and accountability.

Access Bank is making headlines again, but for all the wrong reasons.

The bank has been accused of withholding funds belonging to a deceased customer, Awah Idongesit Edet, despite multiple legal efforts by the late customer’s sister, Bassie Edet Awah, to retrieve them.

The case unfolds

Awah Idongesit Edet passed away on 17th April 2019 at St. Gerard’s Hospital, Kaduna, leaving behind substantial assets.

On his deathbed, he reportedly informed his sister of his bank accounts and properties, but lacked a formal will.

Following his demise, Bassie secured a Letter of Administration from the Kaduna High Court on 20th May 2019, empowering her to claim his assets.

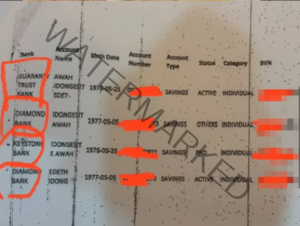

She then approached the Central Bank of Nigeria (CBN), which confirmed the balances in her late brother’s accounts. These included:

GTCO: ₦10 million

Keystone Bank: ₦3 million

Access Bank (Account 1): ₦2.9 million

Access Bank (Account 2): Over ₦500 million

Mixed responses from banks

Both GTCO and Keystone Bank released the funds without issue after verifying the Letter of Administration and CBN confirmation. However, Access Bank presented significant obstacles.

The first account: ₦2.9 million

Access Bank initially denied the existence of the account. It was only after persistent efforts and a confrontation with the branch manager that the bank acknowledged the account’s balance of ₦2.9 million.

The funds were eventually released, but not without frustrations, as the manager allegedly attempted to persuade Bassie to reinvest the money with the bank.

Late Wigwe, who died in a plane crash in February 2024, was the Access Bank’s boss since 2014 till his death

The second account: Over ₦500 million

When Bassie approached Access Bank regarding the larger account, the bank denied its existence altogether.

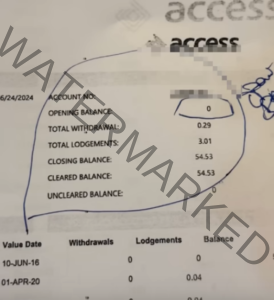

Even after providing the Bank Verification Number (BVN), the bank claimed the account had no funds. A statement issued on 30th December 2019 indicated a balance of just ₦1.68.

Legal battle and allegations

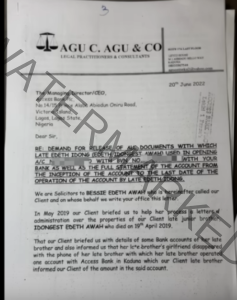

Unsatisfied, Bassie enlisted legal assistance in 2022, demanding the full account history.

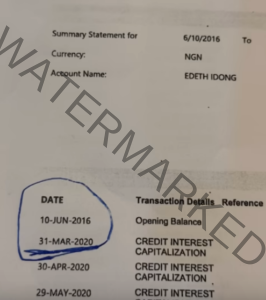

Despite court interventions, Access Bank delayed releasing the requested documents until May 2024, when it issued a statement showing:

The account was opened on 10th June 2016.

No transactions were recorded from its inception until 13th March 2020.

Bassie alleged that the account once held substantial funds but had been siphoned by the bank.

She is now calling on relevant authorities to investigate and ensure justice is served.

This incident has sparked outrage, with many criticising Access Bank for alleged unethical practices. Bassie continues to demand transparency and restitution, urging regulatory bodies to intervene.

Access Bank has yet to issue an official statement regarding these allegations.